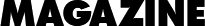

Margie Washichek: The Untold Story Behind Jimmy Buffett’s First Wife

Margie Washichek, best known as Jimmy Buffett’s first wife, played a pivotal yet often overlooked role in his early career. Though their marriage was brief, her support and resilience during Buffett’s formative years left a lasting impact. This article delves into Margie’s biography, early life, relationships, career, and the intriguing facts that continue to spark public curiosity.

Biography and Early Life

Margie Washichek was born on December 25, 1946, in Pascagoula, Mississippi, and spent her formative years in Alabama. She earned recognition as a beauty pageant contestant for her charm and poise. While details about her family remain private, these early experiences shaped her confidence and prepared her for life alongside rising music star Jimmy Buffett.

Even though Margie Washichek became connected to fame, she grew up with strong Southern values and a close community. Because Margie values her privacy, most details about her early life remain unknown, helping her keep a normal life despite her famous connection.

Margie Wshichek and Jimmy Buffett: A Relationship That Shaped a Legend

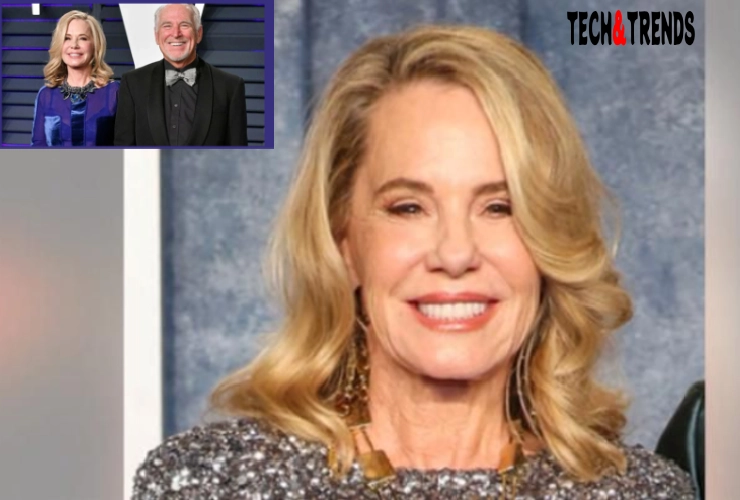

Margie Washichek’s life changed dramatically when she met Jimmy Buffett. The two crossed paths in the late 1960s, and their connection quickly blossomed into romance. Margie and Jimmy married in 1969, when Buffett was still struggling to establish himself in the music world.

During their marriage, Margie played a crucial role in supporting Buffett emotionally and financially. The couple lived in modest accommodations and often faced financial difficulties during their early years together.One well-known story recounts how they spent Thanksgiving heating hot dogs over a hotel sink, a testament to their perseverance and commitment to each other during tough times

Personal Life and Private Nature

Following her divorce from Jimmy Buffett, Margie Washichek deliberately retreated from public attention, valuing privacy over fame. She never remarried and has no known children, maintaining a low profile throughout her life. Margie’s choice reflects her wish for a peaceful, ordinary existence, free from the constant scrutiny and pressures that often come with celebrity associations.

Margie Washichek: Professional Career and Net Worth

During their marriage, she worked as a secretary, helping to support the couple during Buffett’s early career struggles. After their separation, Margie pursued other opportunities, though the specifics of her career remain undisclosed.

Estimates of Margie Washichek’s net worth range widely. Some sources report her wealth at about $15,000 from her career and investments, while others estimate it between $500,000 and $1.5 million, likely due to her divorce settlement with Jimmy Buffett and careful financial management. Claims of a much higher net worth exist but lack credible evidence.

Facts and Lesser-Known Details

- Birthplace and Early Years: Margie Washichek was born and raised in Pascagoula, Mississippi, and spent part of her youth in Alabama.

- Pageant Participation: She was recognized as a beauty pageant contestant in her early years, a detail that highlights her charm and poise.

- Marriage to Jimmy Buffett: Margie and Jimmy Buffett married in 1969 and divorced in 1972. Their marriage was foundational to Buffett’s early career.

- No Known Children: There are no public records of Margie having children with Buffett or anyone else.

- Private Life Post-Divorce: After her divorce, Margie chose to live a quiet, private life, rarely appearing in public or giving interviews.

- Net Worth: Her net worth is estimated between $15,000 and $1.5 million, though exact figures are not publicly confirmed.

- Professional Life: Margie worked as a secretary during her marriage to Buffett and later held undisclosed roles.

- Influence on Buffett: She provided emotional and financial support during Buffett’s early career struggles, playing a significant role in his eventual success.

- No Involvement in Margaritaville: Margie is not involved in Buffett’s Margaritaville business empire or any of his later ventures.

Margie Washichek’s Legacy and Public Perception

Many people remember Margie Washichek because she supported Jimmy Buffett during the important early years of his career. Even though she never wanted fame, her help and encouragement shaped his journey. Fans see Margie as a big influence behind the scenes, showing how important it is to have supportive people who help artists succeed, even if they aren’t in the spotlight.

Margie’s decision to lead a private life has only added to her mystique. In an age where celebrity culture often demands constant visibility, Margie’s choice to remain out of the spotlight is both admirable and rare. She represents a different kind of strength—the ability to walk away from fame and build a life on one’s own terms.

Interesting Facts About Margie Washichek

-

People sometimes mistakenly refer to Margie Washichek as an actress, but most recognize her publicly because of her marriage to Jimmy Buffett.

- She was born on Christmas Day, December 25, 1946, adding a unique detail to her personal story.

-

Fans and biographers still acknowledge Margie’s influence as a key factor in Jimmy Buffett’s early success, despite her brief marriage to him.

- Margie has never publicly commented on her marriage or divorce, maintaining a dignified silence that has only increased public interest in her life.

FAQ

Where was Margie Washichek born?

She was born in Pascagoula, Mississippi, on December 25, 1946.

What is Margie Washichek’s net worth?

Estimates range from $15,000 to $1.5 million, though exact figures are not publicly confirmed.

Was Margie Washichek involved in Jimmy Buffett’s business ventures?

Margie does not participate in Buffett’s Margaritaville brand or any of his later business ventures.

There is no public record of Margie remarrying or having children after her divorce.

Why is Margie Washichek still remembered today?

People remember Margie for the crucial support she gave during Jimmy Buffett’s early career and for choosing to live a private, independent life.

Margie Washichek’s life exemplifies quiet influence and personal resilience. While many recognize her as Jimmy Buffett’s first wife, she displayed remarkable grace, strength, and a strong commitment to privacy. Margie gave unwavering support during Buffett’s early career, which played a key role in his later achievements. Yet, she intentionally stepped away from fame and chose to create a fulfilling, independent life on her own terms.